Business Insurance in and around Shrewsbury

Calling all small business owners of Shrewsbury!

This small business insurance is not risky

Help Prepare Your Business For The Unexpected.

Operating your small business takes commitment, creativity, and quality insurance. That's why State Farm offers coverage options like worker's compensation for your employees, a surety or fidelity bond, extra liability coverage, and more!

Calling all small business owners of Shrewsbury!

This small business insurance is not risky

Protect Your Business With State Farm

At State Farm, apply for the fantastic coverage you may need for your business, whether it's a pet groomer, a bakery or an antique store. Agent Jeff Nelson is also a business owner and understands what you need. Not only that, but customizing policy options is another asset that sets State Farm apart. From one small business owner to another, see if this coverage takes the cake.

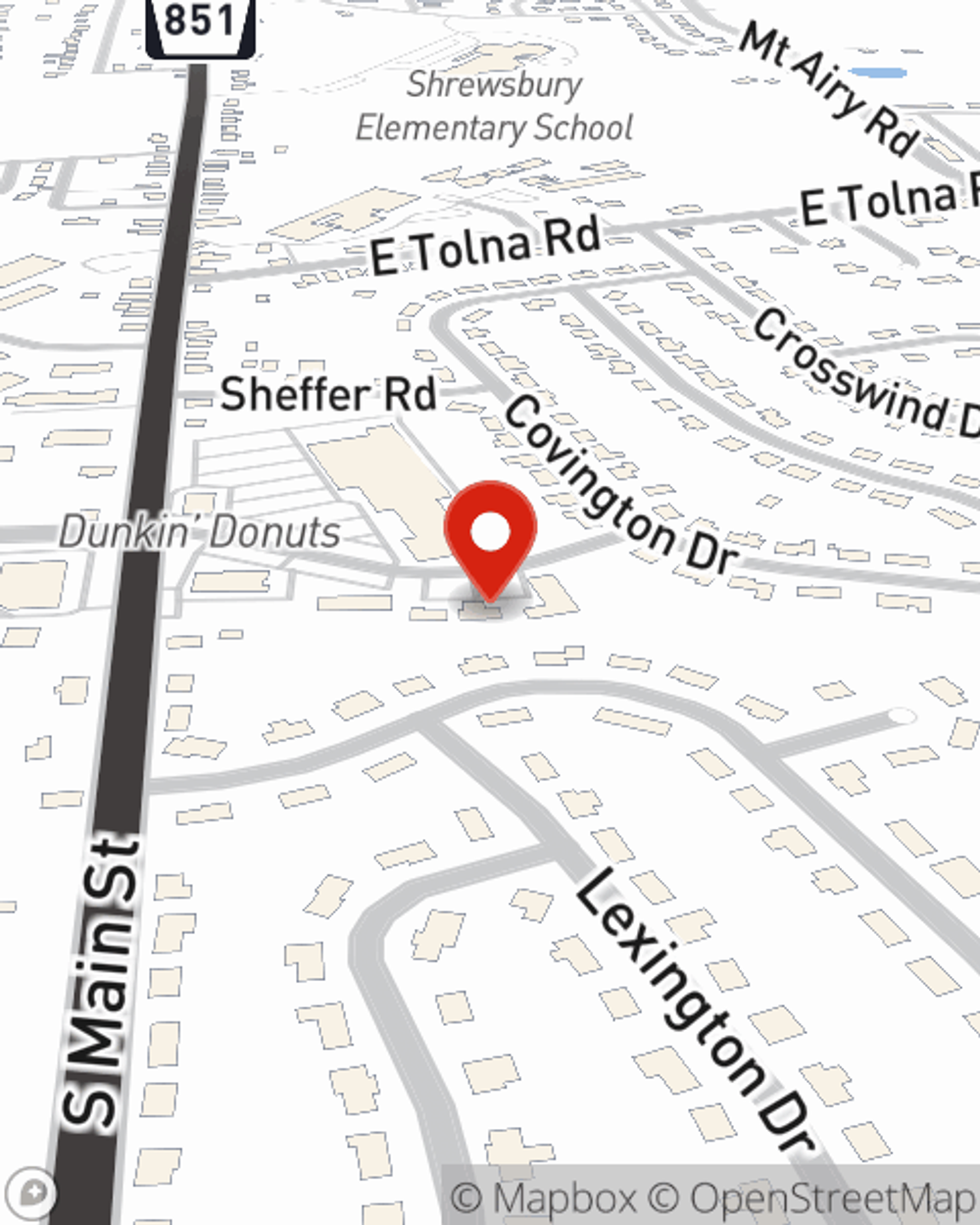

Reach out agent Jeff Nelson to discuss your small business coverage options today.

Simple Insights®

How to write a business plan step by step

How to write a business plan step by step

A business plan helps you get organized, tap into the ideal market, dive deep into the competition & examine your financial situation for the first couple of years.

Top reasons to add an accessory dwelling unit to your home

Top reasons to add an accessory dwelling unit to your home

Look at the rising trend of accessory dwelling units and check out tips to help you decide if one of these small homes is right for your big plans.

Jeff Nelson

State Farm® Insurance AgentSimple Insights®

How to write a business plan step by step

How to write a business plan step by step

A business plan helps you get organized, tap into the ideal market, dive deep into the competition & examine your financial situation for the first couple of years.

Top reasons to add an accessory dwelling unit to your home

Top reasons to add an accessory dwelling unit to your home

Look at the rising trend of accessory dwelling units and check out tips to help you decide if one of these small homes is right for your big plans.